Look on the Bright Side article by Matthew Ward Volatility. An uncomfortable word for most individuals. I’ve have yet to meet anyone that particularly enjoys going through a stock market correc

Not All Traditional IRAs Are Deductible

Not All Traditional IRAs Are Deductible Far too often, many individuals believe they will be able to deduct their IRA contributions. This statement is not always true. Not all IRAs are d

Inheriting an IRA from your Spouse? Know Your Options

You have 4 options for inheriting your spouse’s IRA. Roll over the assets into a new or existing IRA in your own name. Transfer the assets to an inherited IRA. Roll over the IRA assets into a new or e

Tax Strategies the Wealthy Use

Tax Strategies the Wealthy Use Have you wondered if you are maximizing your tax savings? Well, take a look below at 5 ways the wealthy save on taxes. Warren Buffett famously noted that he pays fewer t

Thinking about Long-Term Care? Consider Your Options

Thinking about Long-Term Care? Consider Your Options Your options for Long-Term Care typically are as follows: Save enough and pay privately Buy Long-Term Care insurance Qualify for Medicaid But, how

Investing – Staying The Course

Investing – Staying The Course I stumbled across an excerpt written by a highly respected investment professional. Take a look: “There are many financial concepts we can apply metaphorically to our pe

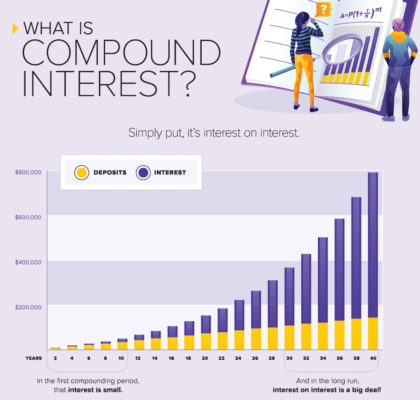

The Magic of Compounding Interest

The Magic of Compounding Interest is rewarded to the patient, disciplined investors. Take the above chart from benzinga.com that shows when an individual invests $5,000 per year for 10 years, a

The SEP IRA or Solo 401K – Which Should You Choose?

The SEP IRA or Solo 401K – Which Should You Choose? Executive Summary: A common question many people face is whether they should set up the SEP IRA or Solo 401K if they are a 1 person firm. One must d

Traditional or Roth IRA – Which Should You Use?

Many individuals ask which is better, the Traditional IRA or Roth IRA. The answer to this debate is: it depends. There are 5 important considerations when choosing between the Traditional IRA and Roth

The Advantages of Structuring Your Business as an S Corporation

Summary: The S corporation is for the small business with under 100 employees. In addition to the vast amount of tax advantages, structuring your business as an S corporation provides protection from