Tax Planning Strategies for Business Owners

There are a number of different tax planning strategies that entrepreneurs and business owners can use in order to reduce their tax liability.

As an entrepreneur or business owner, it’s important to have a tax-focused financial plan in place in order to minimize your tax liability and maximize your profits. A good tax-focused financial plan will take into account your business’s structure, revenue, expenses, and projected growth. Additionally, a good tax-focused financial plan will also consider the different types of taxes that you may be liable for, such as income taxes, sales taxes, property taxes, and payroll taxes.

Some common strategies include deferring income, accelerating deductions, and claiming credits and exemptions. Additionally, many entrepreneurs and business owners also choose to set up retirement accounts, such as Solo 401(k)s or SEP IRAs, which can offer significant tax advantages.

When it comes to tax planning, there are a number of different strategies that can be used in order to minimize your tax liability. However, it’s important to consult with a qualified tax advisor, like New Century Investments, in order to determine which strategies will work best for your specific situation. Additionally, it’s important to review your tax-focused financial plan on a regular basis to make sure that it’s still meeting your needs and goals.

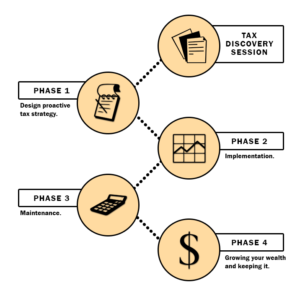

Our firm knows Money Matters. Not only is it important to amass and preserve hard-earned wealth, but it is equally important to keep the most of it you possibly can. Our approach to Forward Tax Planning is integrated with our investment and financial planning philosophy. We have CPAs and CFP® Professionals involved in the process ensuring that we consider each tax implication, ensuring you keep the most of your wealth sheltered from tax.

By using our process, clients can develop an overall strategy for managing their taxes both currently and in the future. We collaborate with you to comprehend your current financial situation and then generate a plan that will reduce your tax burden as much as possible. The financial advisor will take the time to understand your current situation, including but not limited to: Your assets, liabilities, and cash flow; Tax strategies that work for you; The impact of any major changes in your life (such as marriage or divorce) on your wealth. This may include portfolio rebalancing, estate planning, retirement planning, and other issues.

Our ultimate goal is to help you keep as much of your wealth as possible so that you can achieve your financial goals. Contact us today to learn more about how we can help you with forward tax planning.