Managing your finances during retirement is crucial to ensure a comfortable and secure future. One key aspect of retirement planning is developing effective withdrawal strategies that can help your sa

Working Together: Why Great Partnerships Succeed

Working Together: Why Great Partnerships Succeed In the realm of unparalleled success, the synergy of dynamic partnerships often goes unnoticed, yet it’s the cornerstone of some of the most groundbrea

The Advantages of Qualified Charitable Donations: Making a Difference Through Giving

Qualified Charitable Donations (QCDs) offer a unique opportunity for individuals to support charitable causes while enjoying potential tax benefits. By understanding the advantages of QCDs, individual

A Guide to Determining the Ideal Emergency Fund Size

Having an emergency fund is a crucial aspect of financial planning. It acts as a safety net, providing you with peace of mind and financial security during unexpected situations. However, determining

Where to Begin with Setting Financial Goals: A Comprehensive Guide

Setting financial goals is a crucial step towards achieving financial stability and success. Whether you’re looking to save for a down payment on a house, pay off debt, or plan for retirement, having

The Significance of Up-to-Date and Accurate Beneficiary Information on Investment Accounts

When it comes to managing investment accounts, ensuring that beneficiary information is up to date and accurate is of paramount importance. This crucial step not only safeguards the interests of the a

Essential Tax Preparation Tips: Streamline Your Process and Maximize Returns

Tax planning is a crucial aspect of personal finance that often goes overlooked. It involves strategically organizing your financial affairs to minimize tax liabilities and maximize savings. By taking

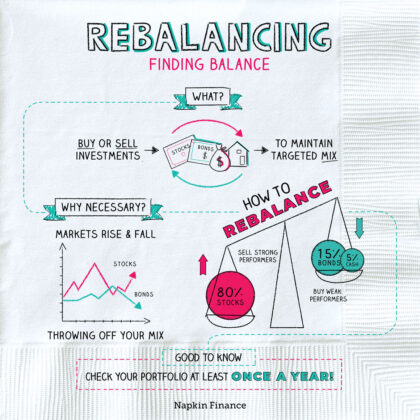

The importance of Rebalancing Investment Accounts

Investing in financial markets can be a rewarding endeavor, but it requires careful attention and management. One crucial aspect of maintaining a healthy investment portfolio is the practice of rebala

Understanding Asset Location: A Key to Tax-Efficient Investing

In the world of personal finance and investment, we frequently encounter the term “asset allocation,” which refers to the mix of asset classes in a portfolio, like stocks, bonds, real estate, cash, an

I’m Never Too Busy to Help Someone You Care About

I’m Never Too Busy to Help Someone You Care About Do you ever feel like that circus act where you have to keep a bunch of plates spinning at the top of tall sticks? I get it. Sometimes it can feel lik