Look on the Bright Side

article by Matthew Ward

Volatility. An uncomfortable word for most individuals. I’ve have yet to meet anyone that particularly enjoys going through a stock market correction. But look on the bright side. Markets go through cycles and they recover from corrections and usually very quickly and unexpectedly. This is important to remember

Did you know, within a few years following a stock market crash, the U.S. market has usually corrected itself and posted gains, even reaching new highs within just a few years? This is such useful information.

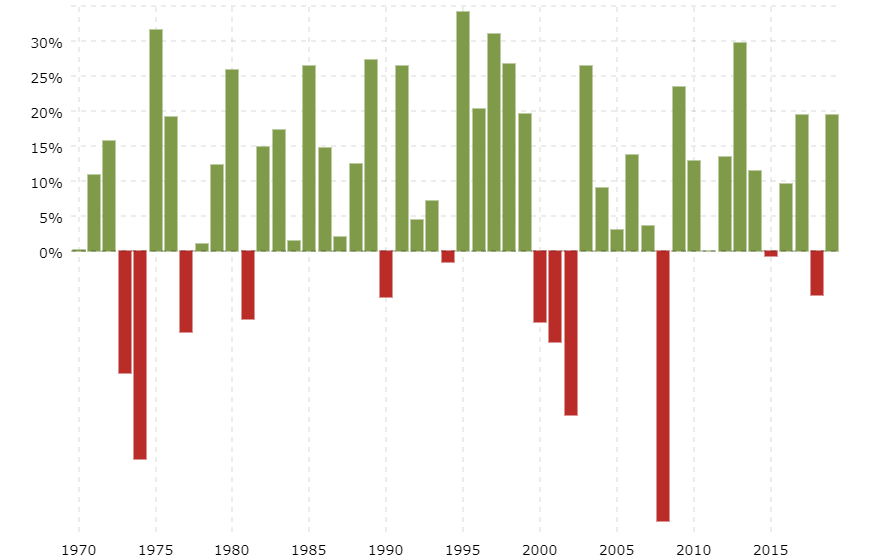

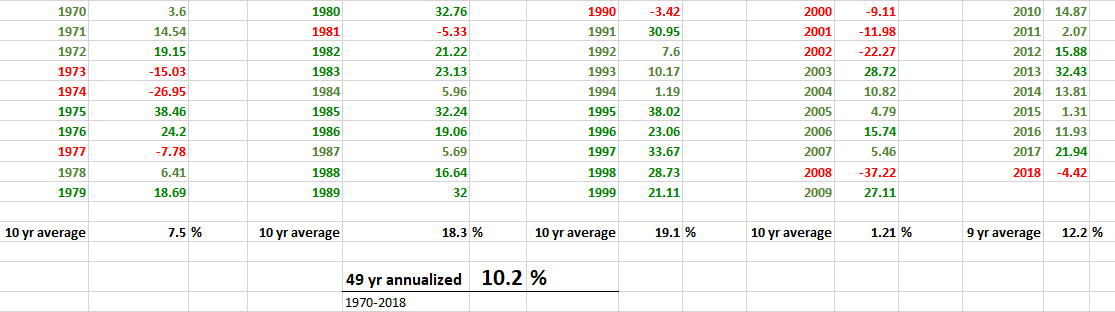

Stock markets can crash unexpectedly, and they also can recover suddenly and unexpectedly. This means that just by staying the course and doing nothing, we inevitably participate in the stock market rebound and reach new highs. See below for the U.S. stock market returns from 1970 through 2018.

If you invested $50,000 in 1970 and nothing else, you would have $1,496,035 as of September 2019. Your money has compounded more than 29x.

But what about if you actually invested $10,000 after the 1974 market crash, another $10,000 in 2002 at the bottom of the Dot.com crash, and third $10,000 after The Great Recession Market Crash in 2009? Your total contribution would have been $80,000 and by September 2019, your investment is now worth $1,619,398. That’s 32x more than you put in.

Take a look at the actual returns below. Let’s begin with the 1973-1974 stock market correction. If you began investing in 1973, your investments were down by the end of 1974. But over the next 2 years, your money grew by +63%. You were ahead +21%. Now, look during 2000-2002. If you began investing in 2000, by 2002, investments were down. But during 2003-2007, your money grew by +65%. You were ahead +22%.

ACTUAL RETURNS PER ANNUM OF THE S&P 500 FROM 1970-2018

By actually buying into stocks while they are down, the disciplined investor is even further ahead. I share this information as a reminder to us all, myself included, why it is important to stay the course.