Transferring EE Bonds into a 529 Plan for College EE Savings bonds can be used for Qualified Education Expenses, and the interest received may be tax-free, if certain conditions are met. In ord

The Best Place to Save for Long-Term Care Expenses

The Best Place to Save for Long-Term Care Expenses Counterintuitively, vehicles offering tax-free withdrawals aren’t always the best for long-term-care savings. Article by Christine Benz The average t

The Ins and Outs of 529s and other College Planning tools

The Ins and Outs of 529s and other College Planning tools As we enter into mid-August, now is the time to be thinking about starting (or adding to) a college fund for your child, or grandchild. There

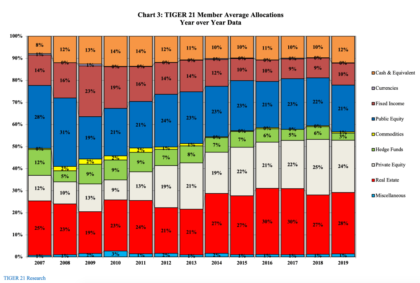

Allocating Your Portfolio: For the High Net Worth Family

ALLOCATING YOUR PORTFOLIO This is the utmost important decision. Before determining which investments, or how to structure your investment vehicles, you must know your desired portfolio. This starts w

Worried about Rising Inflation? Here’s what to do

What if inflation ticks up? Will this impact my portfolio? Many individuals especially those nearing and in retirement are facing this question. An article I have linked here offers a deep dive into F

Why the stock market makes you feel bad some days?

Why the stock market makes you feel bad some days? Money Psychology 101 (3-minute read) You’ve glanced at the markets, it’s a down day, the third this week, and you’re feeling terrible. Why is this? L

Budgeting for a Vacation after COVID

If you’re like many, you are thinking about your next getaway especially after a year like the last one. This doesn’t have to be necessarily an extravagant vacation, but maybe it is. There are a few t

Rising Inflation Expectations

One Year Later: Rising Inflation Expectations Posted: 4/1/2021 by Jurrien Timmer The road to a full economic recovery post-COVID may be paved with higher rates. &nbs

Bitcoin…what about NFTs?

Bitcoin…what about NFTs? By: Matt Ward Date: 3/11/2021 We all have heard of Bitcoin, but we may not all understand it. Bitcoin is a cryptocurrency. A cryptocurrency is a digital or virtual currency

3 Big Policy Areas That Election Outcomes Would Sway

Determining the impact from a change in administration has historically been hard to predict. Political positioning and external factors can have a profound impact on the policies that make it from th