ALLOCATING YOUR PORTFOLIO

This is the utmost important decision. Before determining which investments, or how to structure your investment vehicles, you must know your desired portfolio. This starts with determining how much you want and need. A typical, although there is anything but a typical investor, portfolio for someone with over a $5 million net worth may be 60/20/20, according to James Dahle, M.D.

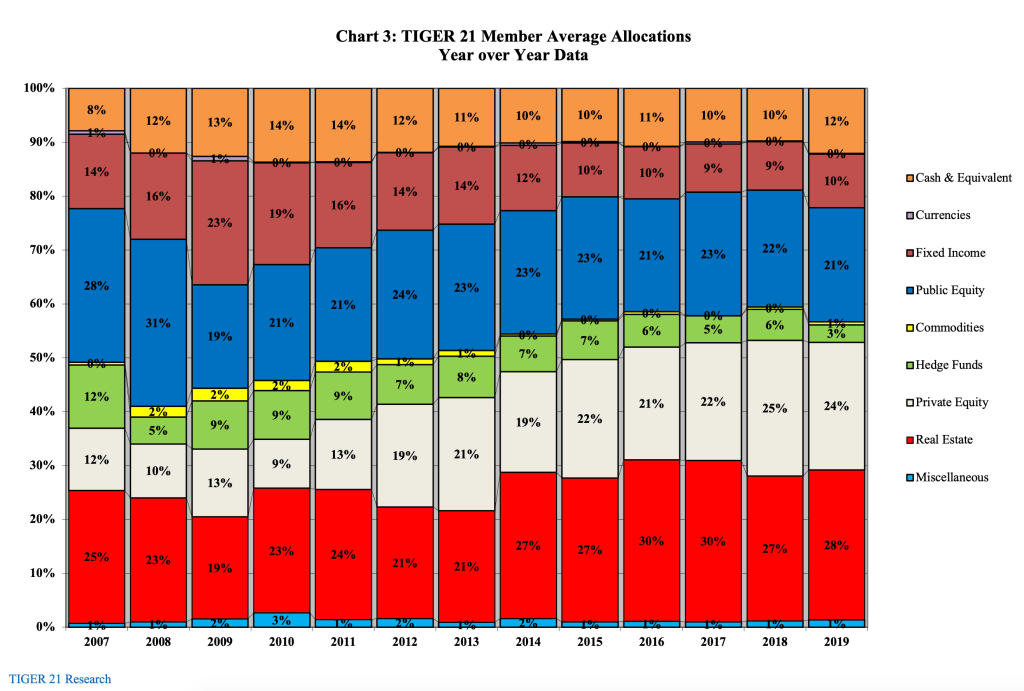

That’s 60% stocks (divided some number between public and private equity, hedge funds, etc.), 20% cash and bonds (again some can may be held privately), and 20% other (this may include things like virtual currency, real estate, commodities, etc.)

In order to come up with your allocation, start with these few steps.

STEP 1: How much do you and your spouse need annually until age 93? Include the cost of Long-term care to be safe. This is your starting point. Then ask yourself, what do you really want? Do you want to leave behind a legacy, spend down your assets, continue growing your empire? First, determining your needs and wants will help you determine how much money you need to spend annually, plus continue to save so you don’t run out.

STEP 2: Determine your Current Financial Positioning. This includes collecting your Net Worth and building that Cash-Flow Statement. Once you know your Net Worth, then you’ll be able to look at your liquid net worth, making sure that it is sufficient for current and future living expenses. Next, depending on your goals, you can determine how much more you need to save, or if you are on track. Your budget will help you make sure you’re allocating the right amounts to where you want to be. And it will show how much room you have for additional saving, or spending. Make sure to use geometric means when projecting returns and to account for taxes when projecting real returns (after inflation).

STEP 3: Draw your Plan. This is just as it sounds. Connect the dots between your current financial position and your future self. This is where you’ll design the portfolio. How much do you want in each category (public/private equity, commodities, etc.), which businesses or alternative assets to invest in (the company, alt, or product), how much in cash reserves, etc. You’ll need to start with conducting a risk tolerance survey. 20% in cash might not be enough cash for someone with an ultra-high net worth that has a low risk tolerance. They won’t need to take the additional risk, and it won’t make them feel better to do-so.

STEP 4: Now, when selecting investments, it helps to think in terms of duration and time horizon. Keeping enough cash and reserves is imperative, but maintaining enough highly liquid investments, like public debt and equity (publicly traded bonds and stocks), is just as imperative. The reason for liquidity may be obvious, but money that you want to grow at a higher rate than cash, will also be available within a reasonable time. For illiquid investments (private debt and equity), making sure you have an expected exit date, or that the business is generating enough current income is crucial. If you’re in the business of flipping homes, you may have a very short time horizon, while someone investing capital in a hotel might have a 7-year time horizon. It will depend but keeping tabs on this will ensure your plan stays afloat.

STEP 5: Monitor your plan. This is where you see the impacts of your investments, your cash flow, and your net worth. Is it going as expected? Is cash flow sufficient? Do you need to make any changes? Has your needs or wants changed? Have you updated projections for inflation? Are you still on track for retirement at your desired age? Do you have new goals? These questions, among several more, need to be asked regularly. That could mean annually. You’ll need to ensure beneficiaries are correct, that assets are titled correctly, stay on top of changing tax laws, adapt with current investment markets, and continue to build knowledge and understanding of your own personal behaviors with money and psychology. These are important characteristics, and only a few, that should be accounted for.

These are the most important, but not all of, the steps to take when determining the allocation of your assets. These categories are limited, you may want a completely different portfolio. There are no boundaries, except for behavioral biases, time horizon, and risk tolerance. One asset allocation could look totally different than another even if both families had the same net worth. Investors with ultra-high net worth’s over $25MM yet again have different considerations that stretch beyond the scope of this article. It is a good idea for higher net worth investors to consult and partner up with accountants, registered investment advisors, attorneys, and other experts in the field so they can ensure they comply with laws and do not leave anything on the table.

Matt Ward, CFP®