As individuals plan for retirement, understanding the intricacies of financial regulations becomes crucial. One such regulation is the Required Minimum Distribution (RMD), which outlines the minimum a

Effective Withdrawal Strategies to Make Your Money Last

Managing your finances during retirement is crucial to ensure a comfortable and secure future. One key aspect of retirement planning is developing effective withdrawal strategies that can help your sa

The Advantages of Qualified Charitable Donations: Making a Difference Through Giving

Qualified Charitable Donations (QCDs) offer a unique opportunity for individuals to support charitable causes while enjoying potential tax benefits. By understanding the advantages of QCDs, individual

A Guide to Determining the Ideal Emergency Fund Size

Having an emergency fund is a crucial aspect of financial planning. It acts as a safety net, providing you with peace of mind and financial security during unexpected situations. However, determining

Maximizing Social Security Benefits: Determining the Best Time to Claim

Social Security benefits play a crucial role in retirement planning, providing a steady income stream for individuals and families. However, deciding when to claim these benefits can be a complex and

Essential Tax Preparation Tips: Streamline Your Process and Maximize Returns

Tax planning is a crucial aspect of personal finance that often goes overlooked. It involves strategically organizing your financial affairs to minimize tax liabilities and maximize savings. By taking

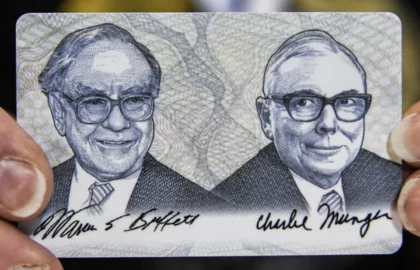

12 Lessons on Money and More From Warren Buffett and Charlie Munger

In the complex world of finance, Warren Buffett and Charlie Munger’s seasoned advice offers a guiding light for investors at all levels. Their strategies and life lessons, honed over years leading Ber

Serving those Who have Served the Most

We understand that managing your finances can be challenging, especially after serving our country. That’s why we’re here to provide you with expert financial advice and assistance tailored specifical

New Rules for Retirement – The SECURE Act 2.0

New Rules for Retirement – The SECURE Act 2.0 The Setting Every Community Up for Retirement Enhancement Act of 2022 (SECURE Act 2.0) was passed in late December, 2022, and it aims to make retirement s

5 money moves to make in your 50s to set yourself up for retirement

Here are 5 smart money moves to make in your 50s. By getting ahead of the ball, you can achieve a successful retirement with your loved ones. Follow our 5 steps and you too will prosper!