Investing in financial markets can be a rewarding endeavor, but it requires careful attention and management. One crucial aspect of maintaining a healthy investment portfolio is the practice of rebalancing. Rebalancing investment accounts involves periodically adjusting the allocation of assets to ensure they align with your long-term financial goals. In this article, we will explore the significance of rebalancing and how it can contribute to the overall success of your investment strategy.

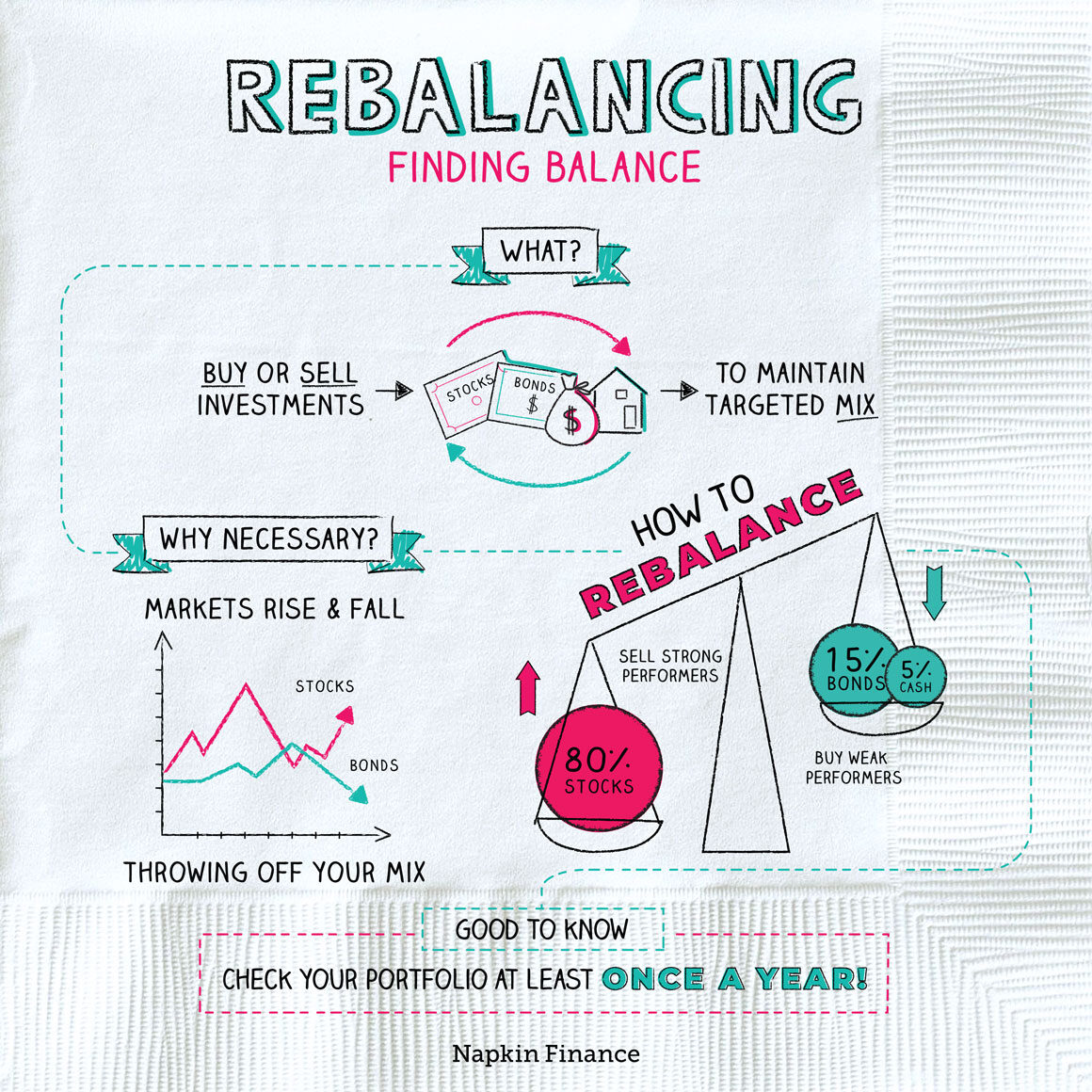

Asset allocation refers to the distribution of investments across different asset classes, such as stocks, bonds, and cash. Over time, market fluctuations can cause the value of these assets to change, leading to an imbalance in your portfolio. Rebalancing allows you to realign your investments to their original target allocation, ensuring that your risk tolerance and investment objectives are met.

One of the primary benefits of rebalancing is risk management. As certain asset classes outperform others, your portfolio’s allocation may shift, potentially exposing you to higher levels of risk. By rebalancing, you can sell some of the overperforming assets and reinvest in underperforming ones, effectively reducing risk and maintaining a diversified portfolio. This disciplined approach helps protect your investments from the volatility of the market.

Rebalancing also plays a crucial role in optimizing long-term investment performance. Studies have shown that portfolios that are regularly rebalanced tend to outperform those that are left unattended. By periodically selling high-performing assets and buying underperforming ones, you are essentially buying low and selling high, a fundamental principle of successful investing. This strategy allows you to capture potential gains and avoid chasing short-term market trends.

As your financial goals evolve over time, so should your investment strategy. Rebalancing provides an opportunity to reassess your objectives and adjust your portfolio accordingly. For example, if you have a long-term goal of saving for retirement, you may gradually shift your asset allocation towards more conservative investments as you approach your target retirement age. Regular rebalancing ensures that your investments align with your changing needs and priorities.

The frequency of rebalancing depends on your investment strategy and personal preferences. Some investors choose to rebalance annually, while others prefer a more frequent approach. It is essential to establish a systematic process that suits your financial goals and risk tolerance. Additionally, consider consulting with a financial advisor who can provide guidance and expertise in rebalancing your investment accounts.

Rebalancing investment accounts is a critical practice that helps maintain optimal asset allocation, manage risk, and enhance long-term performance. By periodically adjusting your portfolio to align with your investment objectives, you can ensure that your investments remain on track to meet your financial goals. Remember, consistency and discipline are key when it comes to rebalancing. Regularly monitoring and adjusting your investments will contribute to a more successful and resilient investment strategy.

About Matt

Matt Ward is a financial advisor and the president of New Century Investments, an independent investment advisory firm serving business owners, pre-retirees, and retirees in the Dallas-Fort Worth area and beyond. Matt is passionate about integrating investing, planning, and tax management into a holistic approach. Matt’s breadth of knowledge and experience in both taxes and investment management sets him apart, giving him the ability to design, advise on, and manage business strategies, tax efficiency, and retirement planning. He is known for his care and attention to detail and works hard to develop personal relationships with each of his clients so they can benefit from his customized service and guidance. He loves walking with his clients through their financial journey, supporting them and celebrating with them as they reach their goals.

Matt graduated from Texas Tech University with a bachelor’s degree and is a certified financial planner™ and chartered retirement planning counselor℠ professional. When he’s not working, you can find Matt hiking, playing the guitar, and spending time with his family. To learn more about Matt, connect with him today!

Matt’s Corner