How to Prepare for Your Financial Future:

A Guide to Setting Financial Goals and Assessing Risk Tolerance

One of the most common questions I get from clients is how to set financial goals. While there’s no formula or magic number that fits every financial situation, there is a process that can help you construct a plan based on your personal situation. It’s been studied and determined by psychologists that writing down goals increases your chance of success. Today’s post will cover the process I use with my clients in order to help them set financial goals and determine their risk tolerance.

Step 1: Determine Your Vision for the Future

The first step to defining your financial goals is to determine your financial vision: what do you want your life to look like financially?

You might already have a clear vision in your head, but if you’re struggling, it helps to do some introspection. What do you want your life to look like in the next five years? Do you want to own a home? Do you want to retire early? Do you want to send your children through college? Do you want to lower your taxes? Make sure to make these goals specific and measurable. This means defining your time horizon, as well as how much money you will need, for your goals. For example, if you want to save on taxes next year, this would result in a different solution than someone wanting to save for retirement in 10+ years.

Step 2: Define Your Time Horizon for Your Goals

When you set goals, it’s important to define your time horizon for the goals. The time horizon refers to the length of time you have in order to achieve your goals. How long are you going to give yourself to accomplish what you’re trying to get done? If you have a long time horizon, then you can take a longer, more methodical approach. If you have a short time horizon, then you may be forced to take a more drastic or immediate approach.

Step 3: Determine How Much Money You Need for Your Goals

When you’re considering risk tolerance and financial goals you need to figure out how much money you need in order to achieve them. If you’re saving for retirement, for example, you need to know how much money you’ll need to live comfortably in retirement. If a person wants to retire in five years and they want to retire with $1 million, after determining the factors below, they may find they need to save $20,000 per year and invest that money so that it grows over time.

Step 4: Assess Your Current Financial Net Worth

When reviewing your risk tolerance and financial goals, it’s important to assess your current financial net worth. This means that you’ll need to take an inventory of all of your financial accounts, including checking, savings, investments, credit cards, and any other loans and debts that you might have. If you’re not sure how to perform a basic assessment of your financial situation, you can use a tool like the NCI Planning tool, which we provide complementary to our clients, to help you assess your financial health. If you’re not in a place financially where you can actually invest in the stock market, then you may want to start with building an emergency fund or looking for ways to increase your income or reduce your debt.

Step 5: Assess Your Current Spending

When reviewing risk tolerance and financial goals it’s important to assess your cash flow. If you want to build your wealth you need to look at your current spending. A lot of people that I talk to admit they don’t know exactly how much and where their money is going. It’s important to track your spending in order to plan and save for your future goals. This is the only way you can accurately predict your future spending and adjust accordingly to meet your goals.

Step 6: Determine Your Risk Tolerance Level

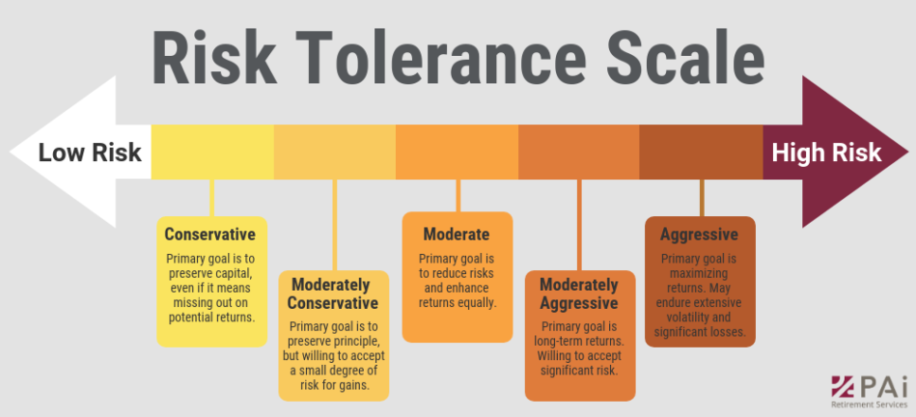

The first step in determining your risk tolerance is to determine whether you’re an optimist or a pessimist. If you’re an optimist, then you believe that opportunities will present themselves and that the future will be better than the present. If that’s the case, you’re likely to be willing to take more risk. If you’re a pessimist, on the other hand, you believe that the future won’t be as good as the present and are likely to want to take less risk. The best way to determine your risk tolerance is to think about how you feel about money.

Your age is another factor likely to affect your risk tolerance. Younger investors are likely to have a higher risk tolerance than older, more stable investors. That’s because young investors have more time to recover from investment market corrections. This is the time to take big risks because you have plenty of time to recover, so there’s no rush.

Recap: The investment strategy you choose should be based on your financial goals, risk tolerance, and investment time horizon.

If you have any questions about determining financial goals or risk tolerance, please feel free to reach out to me at Matt.Ward@newcenturyinvestments.com.

Matt Ward, CFP®

New Century Investments

817-238-6300