One of the most common yet detrimental financial mistakes is not having a budget. Budgeting is the cornerstone of sound financial management, and not having one can lead to overspending and under-savi

Best Financial Practices

Managing finances is an essential aspect of our lives, and it plays a crucial role in shaping our financial future. Whether it’s managing personal or business finances, having effective strategies and

Understanding Asset Location: A Key to Tax-Efficient Investing

In the world of personal finance and investment, we frequently encounter the term “asset allocation,” which refers to the mix of asset classes in a portfolio, like stocks, bonds, real estate, cash, an

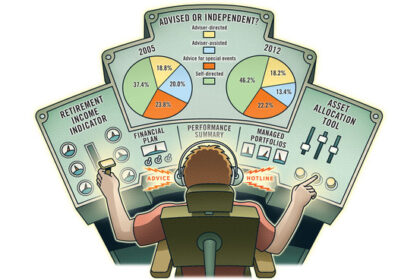

Why Do-It-Yourself Investing May Not be for Everyone

DIY investing refers to the act of individual investors making their own decisions about which investments to include in their portfolios. While it can be an attractive option for those with a keen in

Don’t Put All Your Eggs in One Basket

Diversification, a risk management strategy fundamental to sound investing, involves spreading investments across various financial instruments or sectors to minimize potential damage from any single

The Power of Long-Term Investing

Investing is a powerful tool that can help you grow your wealth and secure your financial future. While there are different investment strategies to choose from, long-term investing has been proven to

Navigating Major Life Events with a Certified Financial Planner

Life is a journey filled with momentous events that can have profound impacts on our financial well-being. Events such as the birth or adoption of a child, the death of a spouse, or a divorce, while e

The Importance of Life Insurance in Your Financial Plan

Life insurance, often overlooked in financial planning, is a crucial pillar that provides a safety net for you and your loved ones. It’s a unique investment, offering both protection and savings, a co

12 Lessons on Money and More From Warren Buffett and Charlie Munger

In the complex world of finance, Warren Buffett and Charlie Munger’s seasoned advice offers a guiding light for investors at all levels. Their strategies and life lessons, honed over years leading Ber

How a CFP Can Assist with Estate Planning

Estate planning is a crucial aspect of financial management that involves the distribution of an individual’s property at their death. Without proper estate planning, the state laws determine how and