How to make a financial plan in 7 steps Whether you take the DIY route or seek professional help, creating a financial plan follows these seven steps: Set goals Track your budget Get that emplo

Why the Wealthy love to Invest in Stocks

Why the Wealthy love to Invest in Stocks The more money you make, the more taxes you pay — right? Not necessarily. “In general, America’s wealthy are different when it comes to tax planning bec

Inheriting an IRA from your Spouse? Know Your Options

You have 4 options for inheriting your spouse’s IRA. Roll over the assets into a new or existing IRA in your own name. Transfer the assets to an inherited IRA. Roll over the IRA assets into a new or e

Tax Strategies the Wealthy Use

Tax Strategies the Wealthy Use Have you wondered if you are maximizing your tax savings? Well, take a look below at 5 ways the wealthy save on taxes. Warren Buffett famously noted that he pays fewer t

Thinking about Long-Term Care? Consider Your Options

Thinking about Long-Term Care? Consider Your Options Your options for Long-Term Care typically are as follows: Save enough and pay privately Buy Long-Term Care insurance Qualify for Medicaid But, how

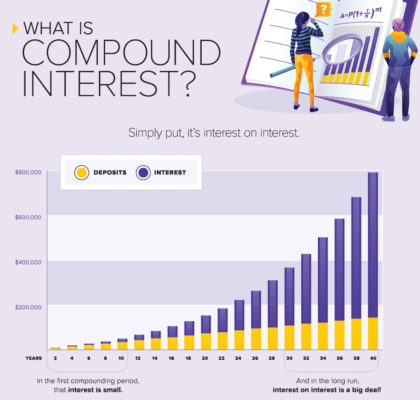

The Magic of Compounding Interest

The Magic of Compounding Interest is rewarded to the patient, disciplined investors. Take the above chart from benzinga.com that shows when an individual invests $5,000 per year for 10 years, a

The SEP IRA or Solo 401K – Which Should You Choose?

The SEP IRA or Solo 401K – Which Should You Choose? Executive Summary: A common question many people face is whether they should set up the SEP IRA or Solo 401K if they are a 1 person firm. One must d

Traditional or Roth IRA – Which Should You Use?

Many individuals ask which is better, the Traditional IRA or Roth IRA. The answer to this debate is: it depends. There are 5 important considerations when choosing between the Traditional IRA and Roth

Why Rolling Over Your 401(K) After Leaving The Job Is A Good Move

Why Rolling Over Your 401(K) After Leaving The Job May Be A Good Move Have you left a company that offered 401(k) benefits? Read this article for some key considerations after you leave a job. And mak

Self Employed? You Can Make $1 Million In 10 Years

Self Employed? You Can Make $1 Million In 10 Years (Or $3.8 Million in 20) Are you self-employed and taking a salary in excess of $146,000? What if I told you it was possible to have $1,000,000 in jus