With the last 10 years delivering 9/10 years of positive stock market returns, we need to begin setting realistic expectations for the next few years. Stocks have averaged 10% annually when we look back. But, hardly ever have returns actually been 7-10%. Take the 10 years from 1970-1979. The returns looked like this:

| 1970 | 3.6 |

| 1971 | 14.54 |

| 1972 | 19.15 |

| 1973 | -15.03 |

| 1974 | -26.95 |

| 1975 | 38.46 |

| 1976 | 24.2 |

| 1977 | –7.78 |

| 1978 | 6.41 |

| 1979 | 18.69 |

This sequence of returns shows that we hardly saw any returns even near the 7-10% average we know as stock market investing.

Rather than fearing market downturns, we should try to welcome them as they lead to greater opportunity. If we had invested during the years the market was negative we actually saw returns closer to 10%!

See the chart below to look at the swings in the S&P 500 by each decade. However, even as there were double-digit swings both ways, we still see an annualized return of 10%. We see from 1930-2019, each decade has posted returns that look like this:

| Year | Double Digit Gains | Double Digit Losses | Single Digit Gains | Single Digit Losses |

| 1930 – 1939 | 4 | 3 | 1 | 2 |

| 1940 – 1949 | 5 | 1 | 2 | 2 |

| 1950 – 1959 | 7 | 0 | 1 | 2 |

| 1960 – 1969 | 7 | 1 | 0 | 3 |

| 1970 – 1979 | 5 | 2 | 1 | 2 |

| 1980 – 1989 | 7 | 0 | 2 | 1 |

| 1990 – 1999 | 7 | 0 | 2 | 1 |

| 2000 – 2009 | 4 | 3 | 2 | 1 |

| 2010 – 2019 | 7 | 0 | 2 | 1 |

| 2020 – 2029 | 4 | 3 | 1 | 2 |

Stock markets rarely return the ~10% average they have posted since 1930. In fact, a lot of the time the returns have been 20% and greater swings. The next several years could be volatile. It could look something like the blue font above, and it could look better, or it could look worse. I’m setting realistic expectations that bull runs don’t last forever. But over time, the bulls win. Businesses continue expanding, economies work towards positive GDP growth, and stock markets trend upward, over time.

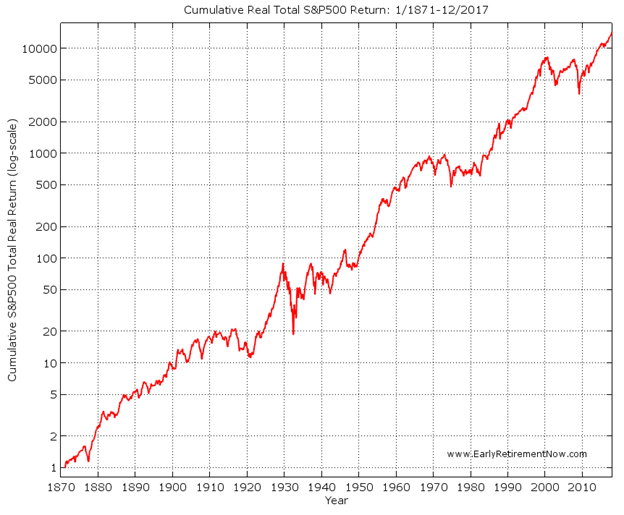

Look at the following chart. History reveals that markets trend upward. There will be periods of volatility and there will be periods of strong growth. Buying when everyone is selling, and when there is volatility, is buying low, the Warren Buffett way. Remember this over the next few years.

Matt Ward, CFP®