Determine Your Net Worth in 3 Easy Steps!

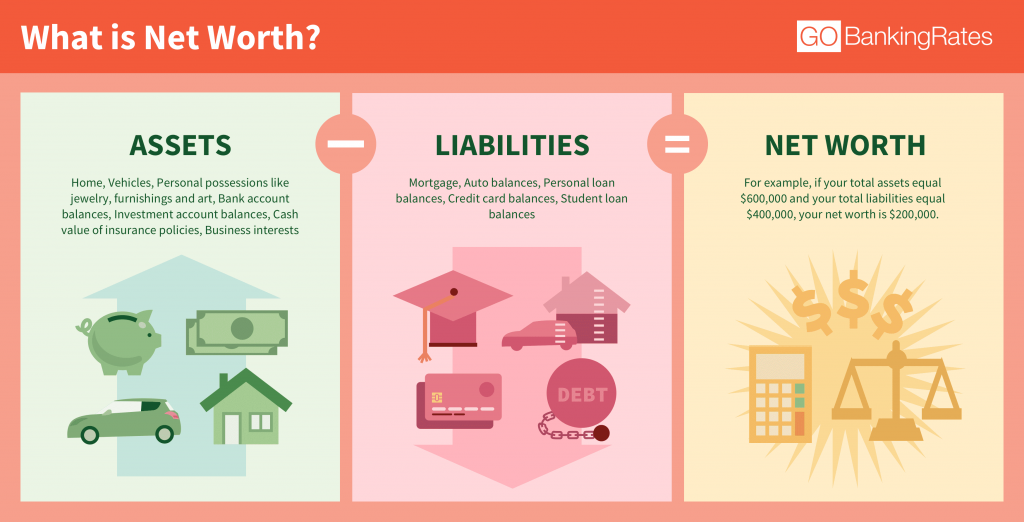

Net worth is a term that gets thrown around a lot, but many people don’t know how to calculate it. Net worth is essentially the difference between what you own (assets) and what you owe liabilities). It’s a great way to get an idea of where you stand financially. In this guide, we’ll walk through three easy steps for calculating your net worth:

Step 1) Gather your financial information.

The first step in calculating your net worth is to gather up all of the financial information that you can. You want to make sure that you have everything necessary for calculating your net worth and then some, so be thorough in gathering this information.

- Get a printout of all bank statements for checking accounts or savings accounts (and any CDs) for the past year or two.

- Get a printout of credit card statements for all credit cards issued in your name during that period, including any store-branded cards (like Sears, Home Depot).

- Get a printout of investment portfolio details (or if you use an online broker like Vanguard or Schwab, get their report). If there are mutual funds involved, include the costs associated with them.

- Retirees: Make sure that you have access to all retirement account balances and their values as well as any pension information available to you.

Step 2) Calculate your assets, or what you own.

This is the most straightforward part of the process. You know what you own, so just add up the value of everything in your possession. If you have a job, list all of your assets that are not used for work—things like a car and personal possessions like jewelry or clothes. Be sure to include any assets that were gifted to you over time, such as an inheritance or birthday present (but not something like a Christmas gift!).

- Cash in bank accounts: $25,000

- Car: $35,000

- Vacation home: $750,000

Step 3) Calculate your liabilities, or debt.

Now that you’ve calculated your assets, it’s time to calculate your liabilities. The first thing you need to do is list all of your debts. This includes all credit cards, student loans, mortgages and car loans. You should also include any other debt that you may have such as medical bills or utilities not included in the mortgage payment. It doesn’t matter if they’re paid off or not—as long as they re still outstanding debts on paper (or electronic records), they will affect the total amount of money owed on each loan per month.

Next up: interest rates! The percentage rate at which these debts accrue is important because it can greatly affect how much money each one costs over time if left unpaid for too long (i.e., an unpaid credit card bill with an 18% interest rate will cost more than twice as much by year’s end than one with an 8% interest rate). If there’s a balance transfer fee involved with transferring balances from one credit card company onto another then include those fees into this step as well; otherwise skip down below where there’s another section explaining how best to manage them effectively!

Net worth is a great way to get an idea of where you stand financially.

Your net worth is a great way to get an idea of where you stand financially. It’s a snapshot of your overall financial health and can help you understand how much money you have and how much debt you owe, in addition to many other things. Your net worth will change over time as you make decisions about your money, so it’s important to take a look at it from

time-to-time.

The thing about net worth is that everyone has one, but not everyone knows what their number is! If you don’t know yours yet—or want to improve it—follow these easy steps for calculating your own personal net worth.

Summary Recap

Determining your net worth is a great way to get an idea of where you stand financially. However, do not get hung up on a specific number. Remember that your net worth will change from month to month and year to year as you make new investments, pay off debts or inheritances come into play. However, having this information available will allow you to make better decisions when it comes time for financial planning or investment opportunities

Contact us if you have any questions!

Matt Ward, CFP®

817-238-6300