One of the most common yet detrimental financial mistakes is not having a budget. Budgeting is the cornerstone of sound financial management, and not having one can lead to overspending and under-savi

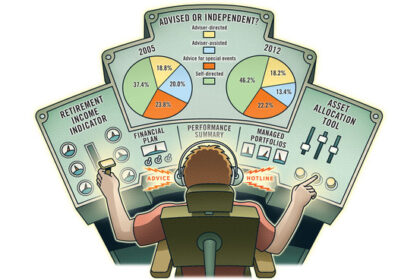

Why Do-It-Yourself Investing May Not be for Everyone

DIY investing refers to the act of individual investors making their own decisions about which investments to include in their portfolios. While it can be an attractive option for those with a keen in

Don’t Put All Your Eggs in One Basket

Diversification, a risk management strategy fundamental to sound investing, involves spreading investments across various financial instruments or sectors to minimize potential damage from any single

The Power of Long-Term Investing

Investing is a powerful tool that can help you grow your wealth and secure your financial future. While there are different investment strategies to choose from, long-term investing has been proven to

Navigating Major Life Events with a Certified Financial Planner

Life is a journey filled with momentous events that can have profound impacts on our financial well-being. Events such as the birth or adoption of a child, the death of a spouse, or a divorce, while e

How a CFP can help with Debt Managment

Debt management can be a daunting task, but with the help of a Certified Financial Planner (CFP), the journey can become more manageable and less stressful. CFPs are trained financial professionals wi

The Importance of Tax Planning and Investments

Navigating the financial landscape can be complex. However, two key aspects of any sound financial plan are tax planning and investments. Effective tax planning can significantly reduce your tax liabi

What to do with your Old Retirement Accounts

When leaving a job, many people are unsure about what to do with their old retirement accounts. This can lead to a jumble of pensions, 401(k)s, and other retirement savings that are difficult to manag

Why Work with a Financial Advisor?

In the world of finance, navigating the labyrinth of investment options, tax laws, and retirement plans can leave you feeling lost and overwhelmed. That’s where a financial advisor comes in. These pro

Why I Became a Financial Planner

Why I Became a Financial Planner By Matt Ward, CFP®, CRPC® I come from a family of financial professionals. Growing up, however, I wasn’t always sure that I would work in the field of finance and inve